- Membangun Kepercayaan : Pelanggan perlu merasa yakin kalau uang dan data pribadi mereka aman. Branding yang kuat itu bisa ngasih pesan kalau perusahaan ini profesional dan bisa diandalkan, jadi lebih gampang buat dapetin kepercayaan dari calon pelanggan. Identitas brand yang jelas bisa komunikasiin nilai, misi, dan langkah-langkah keamanan yang bikin startup fintech ini beda dari yang lain.

- Tampil Beda di Pasar yang Penuh Persaingan : Dengan banyaknya startup fintech di Singapura, branding yang kuat bisa bikin sebuah perusahaan lebih standout. Brand yang unik dan gampang dikenali bikin calon pelanggan cepat paham tentang apa yang ditawarkan dan kenapa mereka harus pilih brand itu dibanding yang lain. Di pasar yang penuh dengan layanan serupa, branding jadi kunci buat menciptakan value proposition yang unik.

- Menyampaikan Inovasi : Fintech itu tentang ngelangkah maju dan embrace teknologi terbaru. Branding yang kuat bisa bantu menyampaikan komitmen perusahaan terhadap inovasi dan teknologi, menciptakan ekspektasi yang tepat buat pelanggan. Entah itu menawarkan solusi pembayaran yang cutting-edge atau financial advice yang personal, branding fintech harus bisa ngegambarin bahwa perusahaan ini ada di garis depan industri.

- Kepercayaan : Seperti yang udah dibahas sebelumnya, kepercayaan itu nggak bisa ditawar di fintech. Membangun brand yang dipercaya itu melibatkan transparansi soal protokol keamanan, jaminan perlindungan data pelanggan, dan konsisten dalam deliver apa yang dijanjikan. Kepercayaan juga termasuk ngasih support pelanggan yang oke dan komunikasi yang jelas.

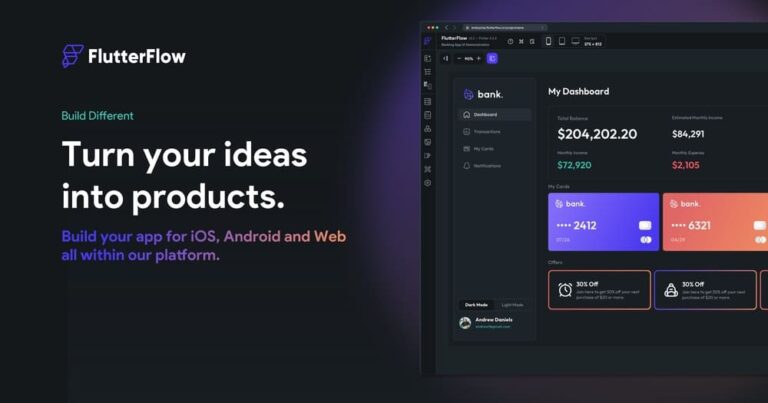

- Inovasi : Perusahaan fintech harus bisa ngegambarin diri mereka sebagai perusahaan yang selalu berpikir ke depan dan teknologinya canggih. Pesan brand, identitas visual, dan interaksi dengan pelanggan harus mencerminkan komitmen ini. Mulai dari desain aplikasi atau website sampai cara bicara di komunikasi, semuanya harus kasih kesan bahwa startup ini ngasih solusi yang up-to-date.

- Kesederhanaan : Solusi fintech sering kali berkaitan dengan proses finansial yang rumit, tapi brand yang kuat harus bisa bikin semuanya terasa simpel dan user-friendly. Pesan yang jelas dan ringkas, interface yang gampang dipakai, dan fokus pada user experience bisa bantu meredakan kerumitan di dunia finansial, bikin brand lebih approachable dan menarik.

- Konsistensi : Brand yang kuat itu konsisten di semua touchpoint, dari sosial media dan iklan sampai desain website dan layanan pelanggan. Ini bantu memperkuat identitas brand di benak pelanggan dan menciptakan pengalaman yang kohesif.

- Revolut : Revolut sukses banget nge-branding diri mereka sebagai solusi keuangan yang tech-driven dan customer-first. Desain mereka yang bold dan modern serta pesan yang straightforward menarik perhatian audiens yang tech-savvy, yang butuh kemudahan dan inovasi. Dengan terus deliver apa yang mereka janjikan dan transparansi layanan, Revolut berhasil bangun brand yang terpercaya dan cutting-edge.

- GrabPay : Sebagai fintech bagian dari Grab, GrabPay ngeposisikan diri sebagai solusi pembayaran yang terpercaya dan user-friendly. Dengan dukungan ekosistem Grab, GrabPay punya pengakuan brand yang kuat dan udah jadi pilihan populer di Asia Tenggara. Fokus mereka pada kemudahan dan kenyamanan bikin mereka sukses banget.

- Wise (dulu TransferWise) : Branding Wise fokus pada transparansi dan fairness di industri keuangan. Mereka jelas banget ngejelasin gimana mereka bantu orang kirim uang ke luar negeri dengan biaya lebih rendah. Branding Wise yang clean dan straightforward bikin mereka dapet reputasi sebagai perusahaan fintech yang jujur dan customer-centric.