Memulai bisnis baru itu seru banget, tapi kamu juga harus bisa atur keuangan dengan baik biar bisnis bisa sukses jangka panjang. Salah satu tugas paling penting untuk setiap startup adalah bikin rencana pengeluaran yang jelas, biar kamu tahu ke mana uangmu pergi dan berapa banyak yang harus dialokasikan untuk berbagai kebutuhan. Tanpa rencana pengeluaran yang terorganisir, kamu bisa gampang banget kehilangan jejak biaya, mengalami masalah cash flow, dan ketemu masalah keuangan yang bisa menghambat bisnis kamu.

Entah kamu mau buka toko online kecil, membuka toko fisik, atau memulai bisnis berbasis jasa, memahami cara membuat dan mengelola rencana pengeluaran adalah kunci untuk menjaga bisnis kamu tetap sehat secara finansial. Di panduan ini, kita akan jelasin langkah-langkah penting untuk membuat rencana pengeluaran untuk startup kamu, sekaligus memberikan tips praktis tentang cara mengelola biaya seiring pertumbuhan bisnismu.

Identifikasi Biaya Awal Startup

Sebelum bisnismu resmi mulai beroperasi, kamu pasti perlu menyiapkan berbagai pengeluaran awal. Ini adalah investasi pertama yang harus kamu lakukan untuk menyiapkan bisnismu agar siap melayani pelanggan. Mulailah dengan membuat daftar semua hal yang perlu kamu bayar di tahap awal. Misalnya, ini bisa termasuk biaya hukum, izin, sewa kantor, peralatan, teknologi, dan upaya pemasaran awal.

Saat menghitung biaya startup kamu, pertimbangkan hal-hal seperti:

- Biaya hukum dan administrasi:Ini mencakup pendaftaran bisnis, perizinan, dan dokumen hukum yang dibutuhkan.

- Peralatan dan teknologi:Ini bisa termasuk peralatan fisik seperti furnitur, alat, atau mesin, serta langganan software dan teknologi yang diperlukan untuk operasi bisnis.

- Pemasaran dan branding awal:Membangun website, membuat logo, dan meluncurkan kampanye pemasaran awal juga masuk kategori ini.

Dengan membuat daftar rinci biaya startup, kamu bisa mendapatkan gambaran yang lebih jelas tentang seberapa banyak modal awal yang dibutuhkan sebelum bisnismu siap beroperasi.

Rencanakan Biaya Operasional Berkelanjutan

Begitu bisnis kamu berjalan, kamu perlu menganggarkan biaya operasional yang berkelanjutan. Ini adalah pengeluaran rutin yang harus kamu bayar untuk menjaga bisnis tetap berjalan sehari-hari. Sementara biaya startup biasanya adalah investasi satu kali, biaya operasional memerlukan pemantauan dan penyesuaian secara teratur agar bisnis tetap menguntungkan.

Biaya operasional umum termasuk sewa, utilitas, gaji karyawan, inventaris, asuransi, dan pemasaran. Tergantung jenis bisnismu, biaya ini bisa bervariasi. Misalnya, toko fisik mungkin memiliki biaya sewa dan utilitas yang lebih tinggi, sementara bisnis online mungkin mengalokasikan lebih banyak anggaran untuk pemasaran dan hosting website.

Memahami biaya operasional ini penting karena pengeluaran ini adalah yang harus kamu bayar setiap bulan. Anggaran operasional yang kuat akan memastikan bisnismu tetap stabil secara finansial dan menghindari masalah cash flow.

Bedakan Antara Biaya Tetap dan Biaya Variabel

Saat mengelola pengeluaran, ada baiknya untuk membedakan biaya menjadi dua kategori: fixed dan variableBiaya tetap adalah pengeluaran yang tetap konsisten setiap bulan, terlepas dari seberapa baik performa bisnismu. Sewa, asuransi, dan gaji karyawan tetap adalah contoh biaya tetap.

Di sisi lain, biaya variabel berfluktuasi berdasarkan aktivitas bisnis. Misalnya, jika bisnismu menjual produk, biaya inventaris dan pengiriman akan meningkat seiring pertumbuhan volume penjualan. Biaya iklan juga bisa bervariasi tergantung pada musim atau strategi pemasaran.

Dengan memahami mana biaya yang tetap dan mana yang variabel, kamu bisa mengambil keputusan finansial yang lebih baik. Ketika penjualan sedang tinggi, masuk akal untuk meningkatkan pengeluaran variabel seperti pemasaran. Namun, selama periode yang lebih lambat, kamu ingin menjaga agar pengeluaran variabel tetap rendah untuk memastikan profitabilitas.

Siapkan Dana Darurat

Setiap bisnis harus siap menghadapi pengeluaran tak terduga. Baik itu peralatan yang tiba-tiba rusak, masalah hukum mendadak, atau kejadian tak terduga seperti pandemi COVID-19, pengeluaran darurat ini bisa memberi tekanan finansial jika kamu nggak siap.

Membangun dana darurat sangat penting untuk menghadapi situasi seperti ini. Aturan umumnya adalah menyisihkan sekitar 10-20% dari pendapatan bulanan kamu untuk biaya tak terduga. Dana darurat ini akan jadi bantalan finansial, yang memungkinkan kamu menangani situasi darurat tanpa mengganggu operasi bisnis atau menyebabkan masalah jangka panjang.

Tinjau dan Sesuaikan Rencana Pengeluaran Secara Rutin

Setelah rencana pengeluaran kamu selesai, penting untuk meninjau secara berkala. Seiring dengan pertumbuhan bisnismu, biaya-biaya juga akan berubah. Kamu mungkin perlu menambah anggaran pemasaran, memperluas inventaris produk, atau merekrut lebih banyak karyawan. Sebaliknya, kamu mungkin menemukan cara untuk mengurangi biaya, seperti menemukan pemasok yang lebih terjangkau atau mengurangi biaya overhead yang nggak perlu.

Tinjau rencana pengeluaranmu setidaknya setiap kuartal untuk memastikan kamu tetap pada jalur dan melakukan penyesuaian yang diperlukan. Ini akan membantu kamu tetap proaktif tentang kesehatan finansialmu dan memberi fleksibilitas untuk beradaptasi saat bisnis berkembang.

Gimana Noethera Studio Bisa Bantu?

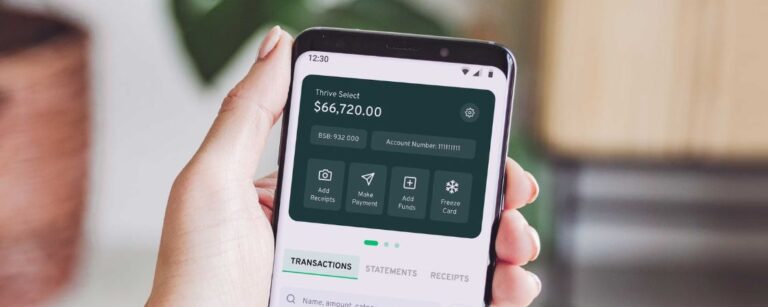

Di Noethera Studiokami paham tantangan finansial yang dihadapi saat memulai dan menjalankan bisnis. Mengelola pengeluaran dan mengatur anggaran dengan bijak sangat penting untuk mencapai kesuksesan jangka panjang, dan kami menawarkan solusi digital yang disesuaikan untuk membantu bisnismu tumbuh. Mulai dari membangun website profesional hingga mendirikan platform e-commerce dan menawarkan layanan pemasaran digital, kami memberikan dukungan komprehensif agar bisnis kamu berkembang.

Tim kami juga bisa membantu kamu mengelola keuangan lebih efektif dengan alat yang melacak pengeluaran, memproyeksikan cash flow, dan membantu kamu membuat rencana finansial yang solid. Nggak peduli di tahap mana bisnismu, Noethera Studio siap membantu kamu berkembang dengan cara yang berkelanjutan dan efisien.

Kesimpulan

Membuat rencana pengeluaran yang jelas dan terstruktur adalah hal yang penting untuk setiap bisnis baru. Dengan mengidentifikasi biaya startup dan operasional, membedakan biaya tetap dan variabel, menyiapkan dana darurat, serta meninjau anggaran secara berkala, kamu bisa menyiapkan bisnismu untuk sukses secara finansial.

Jika kamu siap membawa bisnismu ke level berikutnya, Noethera Studio siap membantu. Hubungi kami hari ini, dan biarkan tim ahli kami memandu kamu melalui proses membangun dan mengembangkan bisnis dengan percaya diri.